In 2018, EU member states agreed on a comprehensive set of laws aimed at preventing the creation of household waste and boosting recycling. The new laws transpose the provisions of the 4 EU directives: Directive 2008/98/EC on waste (WFD), Directive (EU) 2018/850 on landfills (LD), Directive 94/62/EC on packaging and packaging waste ( PPWD) and Directive (EU) 2019/904 on reducing the impact of certain plastic products on the environment. All member states are expected to reflect the agreed EU laws in their national legislation by July 2020.

Article 4(3) WFD calls on Member States to use economic instruments to provide incentives for effective application of the waste hierarchy.

Spain is one of the EU member countries that applies economic instruments of this type Fees and restrictions for waste storage and incineration.

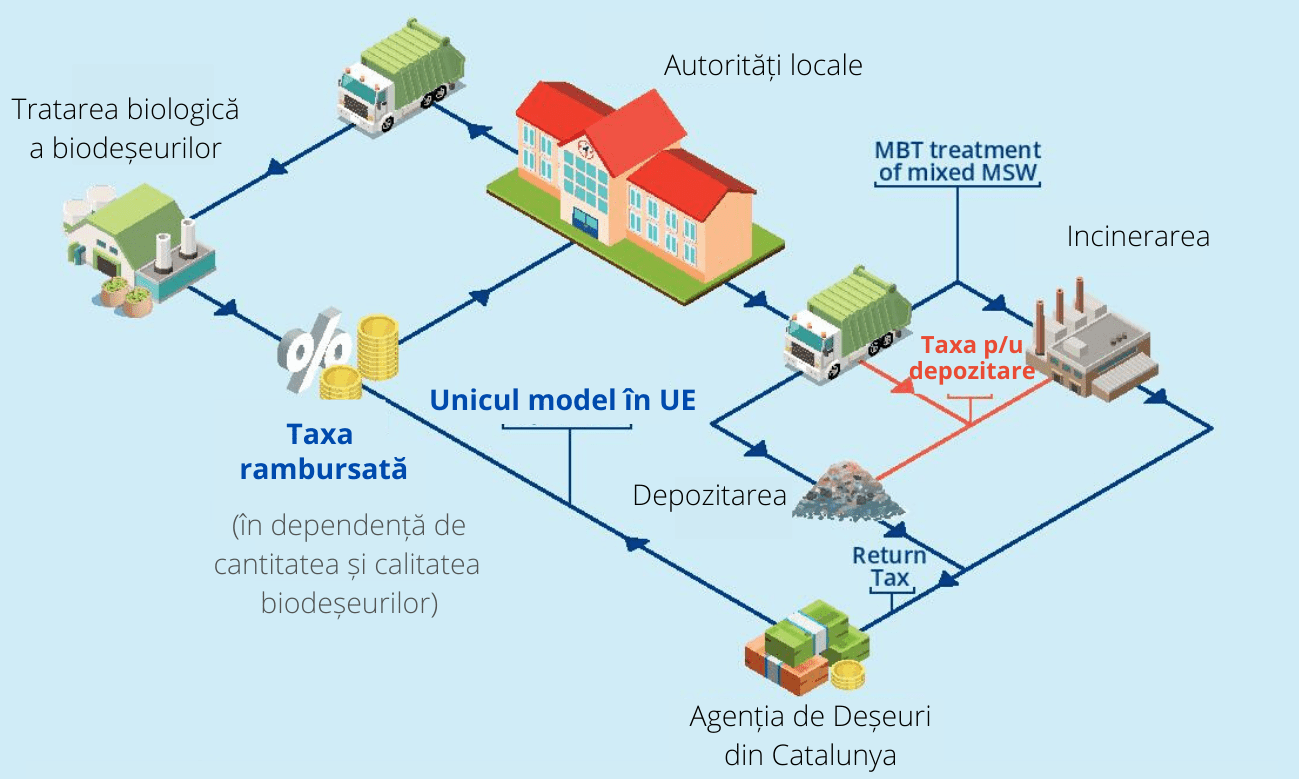

Application of tax refund criteria for waste storage and incineration in Catalunya!

In Spain, the Catalonia region has introduced the waste storage and incineration tax, with tax refund criteria for municipalities. The fees and taxes collected are allocated to improve the waste management system, respecting the principle of the waste hierarchy.

Through the taxes applied, Catalan legislation encourages local authorities to improve separate collection and, by reducing the disposal and incineration of mixed waste.

Catalunya has introduced mandatory separate collection of organic waste for all municipalities in the region (Catalonia Waste Law 9/2008).

This approach of subsidiarity in the application of taxes at the municipal / regional level was a recommendation in the framework Report of the Commission of preventive warning for Spain. Spanish Waste Law allowed regions in the country to use economic incentives.

Catalonia redirects waste away from landfill and incineration (with a particular focus on biodegradable) through its waste disposal tax (Law 8/2008). Tax refund criteria for municipalities were introduced to provide a financial incentive for better management of biodegradable waste. This is the only tax in the EU that targets municipal solid waste, allowing revenue to be returned to taxpayers based on their performance.

Catalonia redirects waste away from landfill and incineration (with a particular focus on biodegradable) through its waste disposal tax (Law 8/2008). Tax refund criteria for municipalities were introduced to provide a financial incentive for better management of biodegradable waste. This is the only tax in the EU that targets municipal solid waste, allowing revenue to be returned to taxpayers based on their performance.

The landfill fee collected is used to further improve waste management.

At least 50% of the money is allocated for biological treatment of biowaste and mechanical-biological treatment of residual waste. The rest of the revenue is paid back to local authorities based on their performance. Landfill and incineration taxes have increased the costs of these types of waste treatment, while encouraging the implementation of separate collection of all waste streams. The results show that the municipal solid waste tax helped increase recycling and reduce waste in all countries where it was adopted. It is an effective measure that should become mandatory in all European countries and beyond.