Italy: "Pay for what you throw away"

Details

"Pay for what you throw away" (PAYT) este un alt instrument economic care țintește înspre conștientizarea consumatorilor cu privire la faptul că deșeurile costă, având de asemenea ca obiectiv inducerea acelorași comportamente precum reducerea deșeurilor generate, creșterea gradului de reciclare și reducerea cantităților depozitate.

In Italy, the public company The counter uses the PAYT ("Pay-as-you-throw") system, which involves charging based on the actual amount that a household or person generates.

The counter deservește 554.000 de locuitori din regiunea Veneto din Italia. Astfel, 85% din deșeuri sunt colectate separat direct la sursă și se generează doar 53 kg de deșeuri per locuitor pe an. Colectarea are loc prin metoda de la ușă la ușă (door-to-door). Aceste lucruri au devenit posibile datorită Decretului legislativ nr. 22/1997, Article 49 Determination of the tariff, which allowed municipalities in Italy to adopt PAYT schemes.

The PAYT tariff for the generation of waste from Contarina is formed from a fixed part and a variable part. The flat fee is based on the number of household members. The variable fee, charged in addition to the fixed fee, is based on the amount of residual waste collected from bins and garden waste. Households that compost get a 30% reduction from the variable tax.

Each household, depending on the number of people, has a fixed number of collections per year, and they can empty their bin a certain number of times before paying more for additional collections. Separately collected waste (recyclables such as plastic, glass, paper, metal) is collected through the door-to-door system and does not involve additional fees.

This type of system minimizes waste production and promotes home composting. The less waste a household generates, the less it pays.

Evolution of the growth of separate waste collection (2000-2014)

Also in Italy, the municipality of Treviso uses PAYT waste tax rates in Its Tax on Waste and Services Regulation (TARES) . It defines a fixed and a variable part of the waste tax for domestic and non-domestic users. The regulation also provides tax incentives for domestic composting.

Article 19 of TARES provides – for domestic users who sort biodegradable waste through composting at home, li se aplică o reducere de 20% a porțiunii variabile a cotei de impozitare. This reduction is possible only after submitting a specific request that certifies that home composting will be carried out continuously during the following year. The exemption applies starting from January 1 of the year following the submission of the application.

According to statistics, in Italy, during 14 years, the percentage of waste collected separately and respectively recyclable increased by 58.2% thanks to the incentives of the PAYT schemes implemented in the country.

Related articles

Reacțiile la studiul publicat recent de Agenția Franceză pentru Siguranța Alimentelor, Mediului și Sănătății Ocupaționale (ANSES)

De ani de zile, marcăm simbolic Ziua Mediului, vorbim despre reducerea poluării cu plastic, venim cu

Modelul economic actual este construit în mare parte pe un sistem liniar de tip „extrage-produce-aruncă”, în

În contextul economiei circulare și al gestionării eficiente a deșeurilor, mecanismul de Responsabilitate Extinsă a Producătorului

În tranziția spre economie circulară, exporturile de materii prime reciclabile din Uniunea Europeană către țări terțe

Centrul de Instruire și Consultanță E-Circular anunță organizarea unei noi ediții a cursului „Raportarea de sustenabilitate

Ziua Internațională “Zero Deșeuri” sărbătorită pe 30 martie și facilitată în comun de Programul Națiunilor Unite

Termenul ESG și raportarea de sustenabilitate sunt tot mai cunoscute în Republica Moldova, mai des utilizate

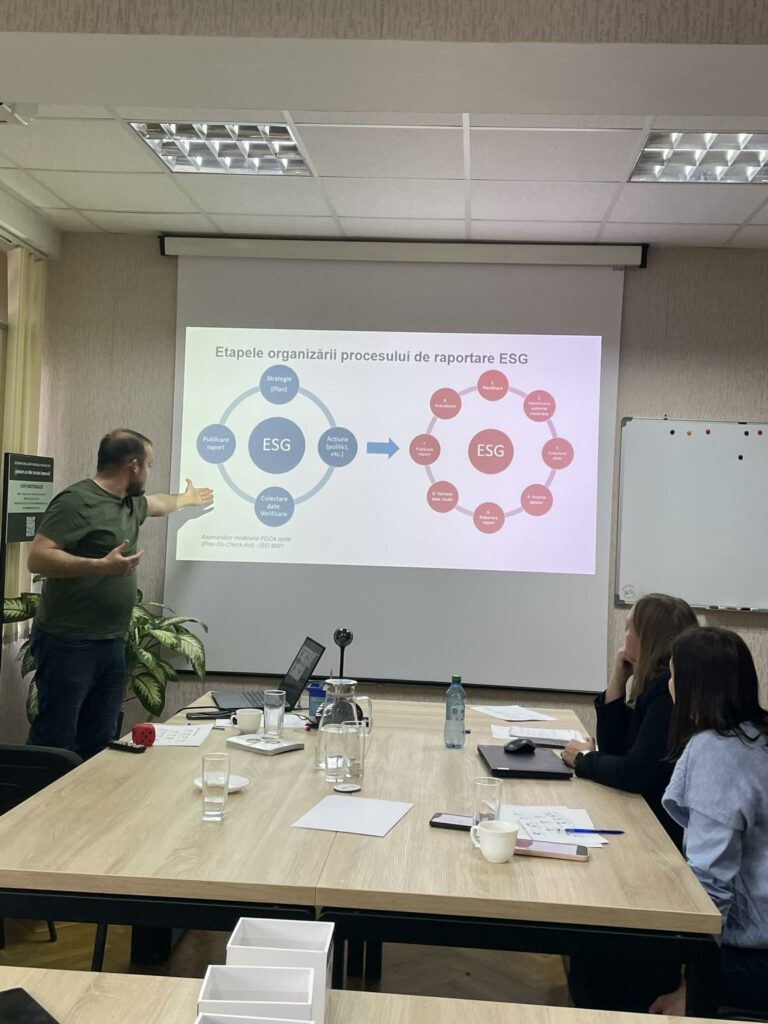

În perioada 12-19 martie 2025, Centrul de instruire și consultanță E-Circular a organizat cursul „Raportarea de

La data de 20 mai 2024, a intrat în vigoare noul Regulament UE 2024/1157 privind transportul deșeurilor