Environmental taxes can be an incentive to reduce pollution

Details

The negative influence of economic development on the environment has been recognized for a long time. Against the background of the multiple challenges generated by the need to protect the environment, governments are now facing increasing pressure to identify new ways to reduce the impact of human activities on the environment, without affecting economic growth. It goes without saying that the influence of these measures will be reflected on the activity of producers, he states Laura CIOBANU, Manager, Climate Change and Sustainability, EY Romania.

Plastics have become a major concern and priority for the European Union (EU) as more and more plastic products are produced. For example, in 2016, approximately 60 million tons of plastic were produced in the EU, according to Plastics Europe, 20 times more than in the 60s. Of the total amount, almost 40% consists of plastic packaging. It is important to note that these values do not include PET fibers, which would imply a significant increase in the final quantities.

Although the recycling rate of plastic packaging has increased throughout the European Union, to almost 41% in 2016, we must take into account that plastic production is also growing at an alarming rate.

"In this context, environmental taxes play an important role and are a useful tool in raising awareness among companies, but also among the population, which must take into account the impact on the environment and also understand how they translate in the costs of their activities or behaviors", declared Laura CIOBANU.

According to it, as a result, in many countries, the level of taxes charged to all companies that place packaging on the national market is quite high. These types of taxes increase the price of finished products, but they also provide an incentive for:

- Increasing innovation performance: companies need to develop new types of packaging, made from more resistant materials, which can be repaired more easily and which can be reused. An additional benefit of using reusable packaging is the fact that environmental taxes are paid only once, and not every time that packaging is placed on the market;

- Optimizing the way goods are packaged, as well as optimizing the shape of the packaging, so that the consumption of materials/raw materials is reduced;

- Encouraging companies to design and use plastic packaging that is easier to recycle, so as to promote the development of more sustainable packaging;

- Improving the separate collection of waste to ensure a better quality of resources used in the recycling industry.

Thus, the tendency to adopt the circular economy concept as widely as possible, in which a major emphasis is placed on the reuse and recycling of products and materials, rather than their disposal, is noted. Given this, but also the fact that by 2030 all plastic packaging placed on the EU market must be reusable or recyclable, now is the best time for companies to start really innovating, rethinking their strategy, and the protection its environment represents one of the main pillars in the transition to a sustainable business model.

We can also note among Romanian companies a growing interest in various solutions adapted to the requirements of the circular economy. An example would be reverse logistics where companies can adopt, for example, return policies that allow consumers to get rid of old products when purchasing new ones. In this way, both the materials contained in the product and their packaging can be reused or recycled after the product's useful life has ended. At the same time, this approach could also offer the option that not only used products, but also spare parts or components can be returned, to go towards remanufacturing, repair or recycling, depending on the most suitable solution.

Another opportunity is related to the replacement of single-use plastic materials, given the adoption by the European Parliament of the Directive on single-use plastic products. In this context, by 2021 disposable plates, cutlery, drinking straws, ear sticks and others will be banned. Therefore, companies did not think too much and started coming up with alternatives to traditional plastic packaging, such as those made from corn starch or sugar cane.

It is true that, in the short term, the transition to a sustainable business model may seem less profitable. In the long term, however, economic studies have shown that sustainability will lead to an increase in process efficiency, which will later translate into a cost reduction. In addition, turning to these new solutions also comes with benefits in terms of reduced pollution, less waste generated and a positive impact on human life and the environment. At the same time, it is important to mention that these efforts could be financed through EU research funds.

So, we can say that environmental taxes can have a positive role in encouraging companies, organizations, but also final consumers to change their behavior. Thus, they can represent not only a tax instrument, but also an economic lever with a significant role in solving environmental problems and reducing the negative impact on the environment.

Related articles

La Geneva, se negociază începînd cu 5 august un acord ONU împotriva deșeurilor din plastic. Blocajul:

Reacțiile la studiul publicat recent de Agenția Franceză pentru Siguranța Alimentelor, Mediului și Sănătății Ocupaționale (ANSES)

Modelul economic actual este construit în mare parte pe un sistem liniar de tip „extrage-produce-aruncă”, în

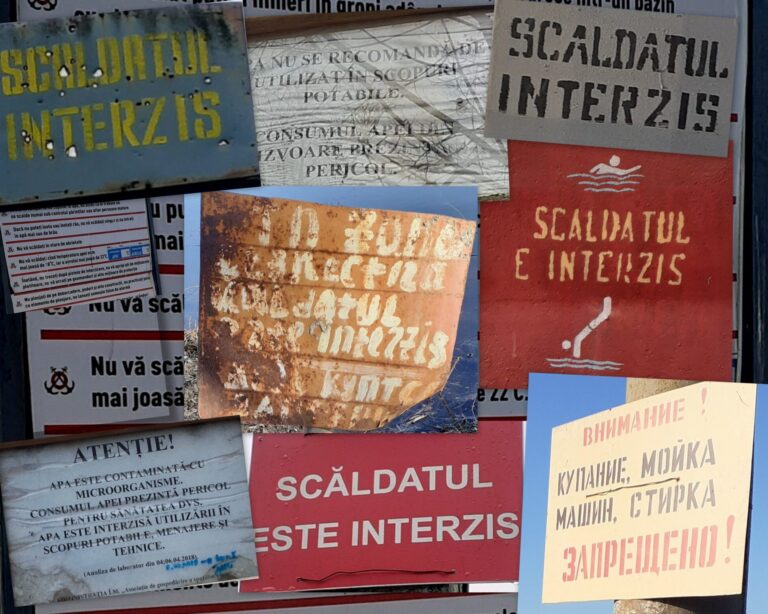

Ziua Mondială a Apei, sărbătorită anual din 1993 la data de 22 martie, este o inițiativă

Centrul de Instruire și Consultanță E-CIRCULAR anunță lansarea campaniei „Martie ECO-ACTIV-Reducem impactul, creștem responsabilitatea!”, o inițiativă

AO The E-Circular Training and Consulting Center as a media partner announces the organization of a

For more than six years, environmentalists have been resisting the oligarchic clans in agriculture, who want to

The Bureau of International Recycling (BIR) launched for the first time in 2018 – “Global Day

Water plays a unique role as a substance that determines the possibility of existence and the very life of all beings on Earth